In today's digital world, where online shopping is not just a convenience but a necessity for many, understanding e-commerce-related tax compliance has become crucial for entrepreneurs. This guide explores in depth everything you need to know to navigate the sometimes turbulent waters of digital taxation, while keeping your business in line with current regulations.

Knowing the Bases: VAT and Income Tax

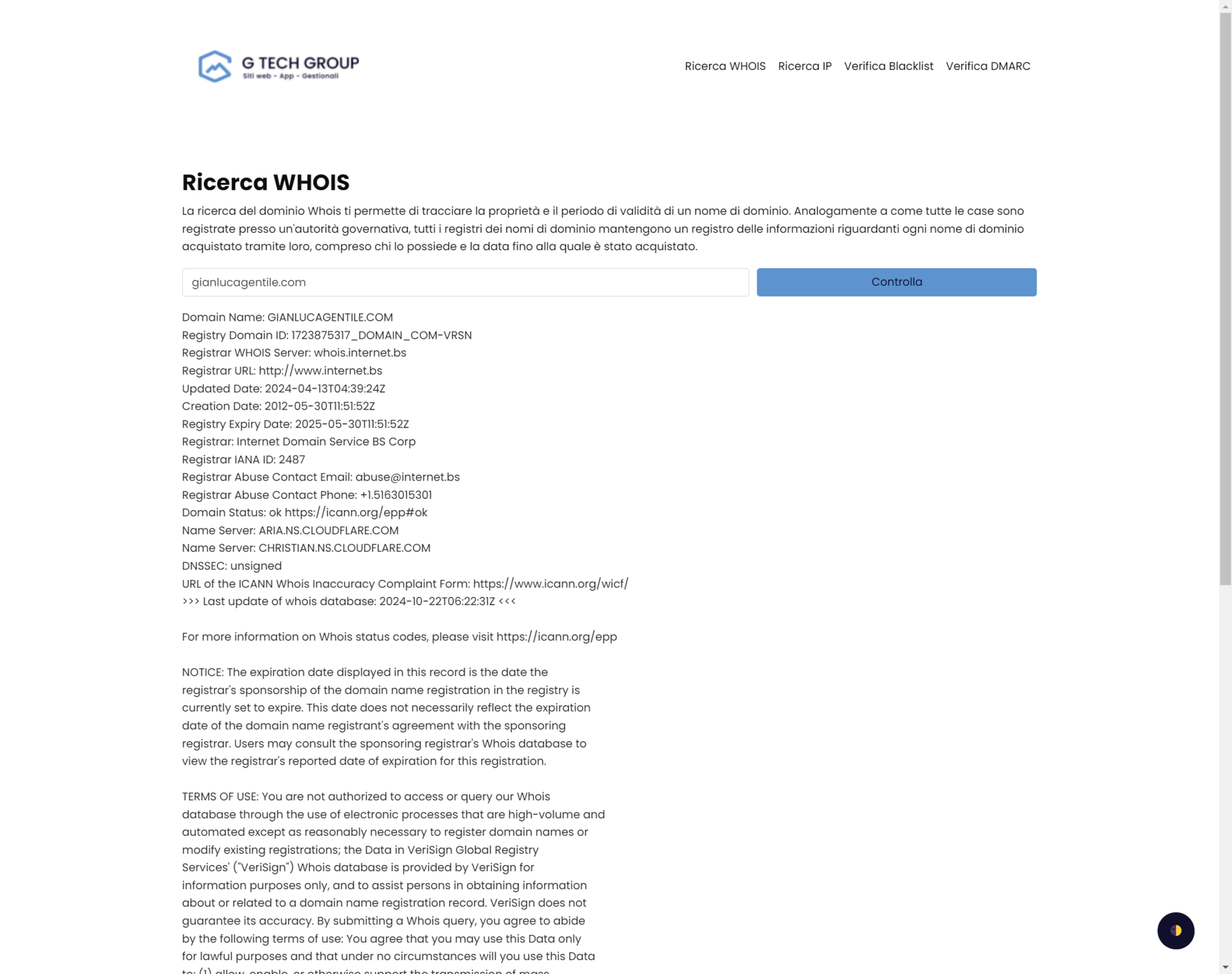

Starting from the ground up means understand Value Added Tax (VAT) and income tax related to your e-commerce. VAT, in particular, can vary considerably depending on the country of residence of your customers, an aspect that has become even more relevant with the entry into force of the New EU VAT rules for e-commerce in 2021. It is essential properly configure your website to adapt to these variations, this includes the registration at MOSS (Mini One Stop Shop) if you make digital sales to other EU countries. This step is not just a formality but a necessity to ensure the correct application of VAT e avoiding sanctions.

Registering Your Business and Understanding Local Taxes

Do not neglect theimportance of registering your business in accordance with the laws of your country. This process gives your company a fiscal legitimacy and gives you a clear understanding of the specific fees that could affect your business, including the corporate income tax and the local taxes. Registration not only positions you as a responsible entrepreneur vis-à-vis the tax authorities, but also paves the way for a more informed and conscious handling of the tax obligations your business has to fulfil.

Documentation and Record Keeping

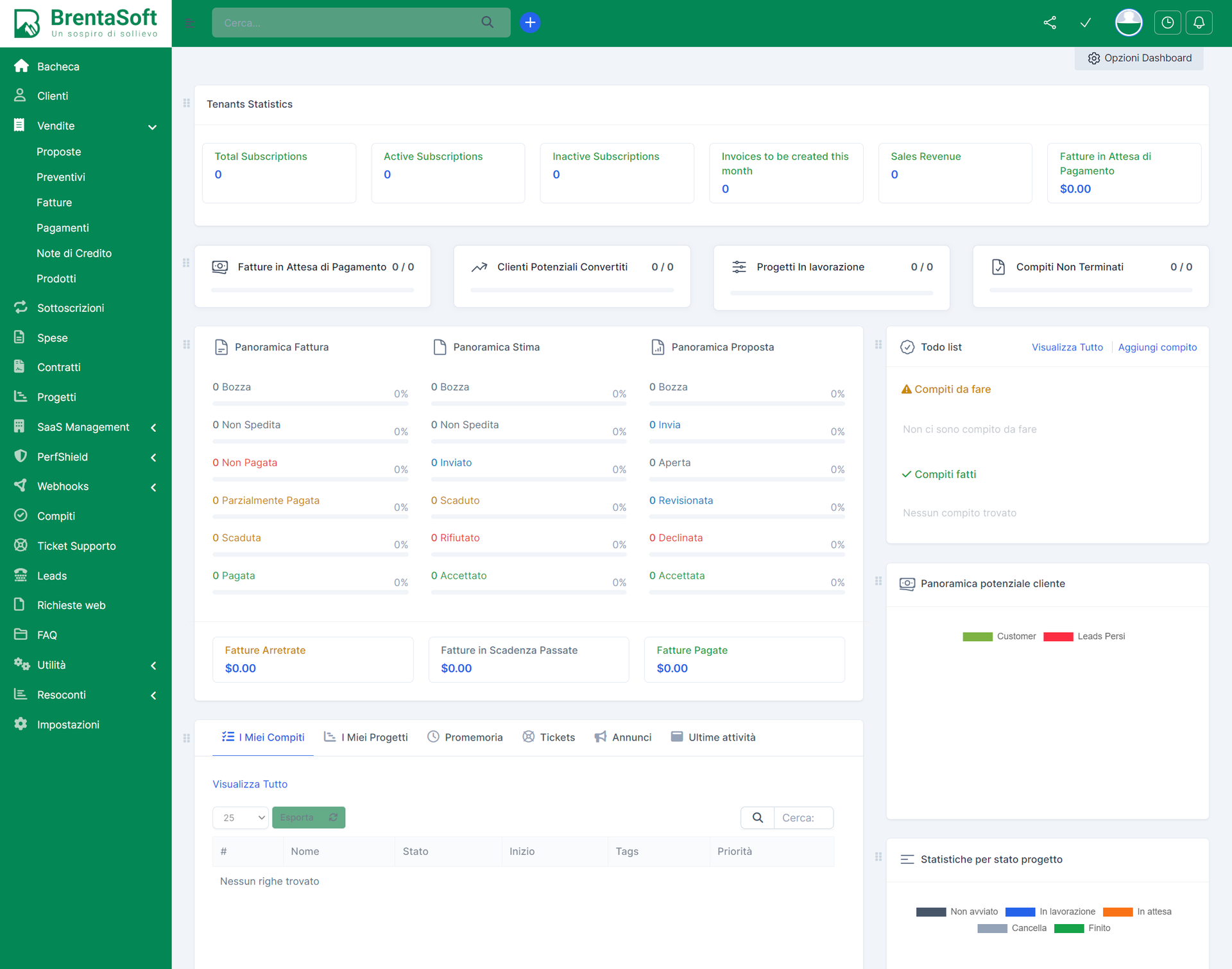

A fundamental, but often underestimated, component of fiscal management is the proper documentation and preservation of financial records. This area covers everything related to invoices, receipts and transaction records. The adoption of digital tools and accounting software can greatly facilitate this task, ensuring that you are always ready for possible tax inspections. Maintaining an up-to-date digital archive of documents not only simplifies day-to-day management but also ensures that every financial detail is traceable and easily accessible.

Fulfilling International Standards

Managing an e-commerce operating on a scale international introduces a higher level of complexity in terms of tax compliance. You will be called upon to navigate between tax regulations of different countriesto manage VAT on several fronts and, potentially, to deal with customs duties. It is essential becoming familiar with trade agreements existing between your country and those of your customers to maximise tax efficiency and minimise the impact of duties. This not only optimises your tax burden but also allows you to navigate a complex regulatory landscape with confidence, avoiding potential penalties and facilitating smoother global expansion.

Using Technology to Your Advantage

Don't reinvent the wheel. Technology is a valuable ally in simplifying your e-commerce tax compliance. Thanks to advanced accounting software, specific plugins for VAT calculationand solutions such as Invoice24you have at your disposal a wide range of tools designed to optimise the fiscal management of your online business. These tools not only automate complex processes, but also guarantee accuracy and regulatory compliance, allowing you to focus on developing your business without additional worries. Fattura24, in particular, is ideal for those looking for an integrated solution that facilitates invoicing, VAT management and financial record keeping, all in one easy-to-use tool.

Professional counselling: When it is Time to Seek Help

Despite the availability of numerous technological resources, there may be times when fiscal management becomes too complex to be dealt with independently. In these circumstances, contact a professionalas a accountant specialising in e-commercemay turn out to be a winning move. An expert can provide you with personalised consultancyguiding you through tax challenges and ensuring you meet all legal obligations. This specialised support not only helps you navigate the complex tax landscape with confidence, but can also offer optimal strategies for the financial growth of your business.

Conclusions

Navigating the complex universe of tax compliance for e-commerce can seem daunting, a veritable maze of rules and regulations. However, armed with the correct information and the right toolsit is possible to cross it with confidence and success. The key to success lies in being proactiveis essential keeping abreast of the latest regulationsmake the most of the technology available and, when the situation calls for it, do not hesitate to seek professional support qualified.

For an even deeper immersion in these topics, it is advisable to consult reliable sites such as the Internal Revenue Service in your country or specialised guides available on online platforms dedicated to e-commerce taxation and legality.

Remember: a efficient fiscal management and state-of-the-art not only ensures your compliance with current laws but can turn into a competitive advantage important for your online business. Good navigation into the fiscal world of e-commerce, where preparation and information are your best allies for the smooth and productive running of your business!